In the labyrinthine world of real estate investments, a 1031 exchange is a valuable maneuver to defer capital gains and foster wealth accumulation. To navigate this complex process effectively, partnering with a qualified 1031 exchange CPA becomes essential. These professionals play a critical role in ensuring your transaction adheres to IRS rules while maximizing financial benefits.

Why Hire a 1031 Exchange CPA?

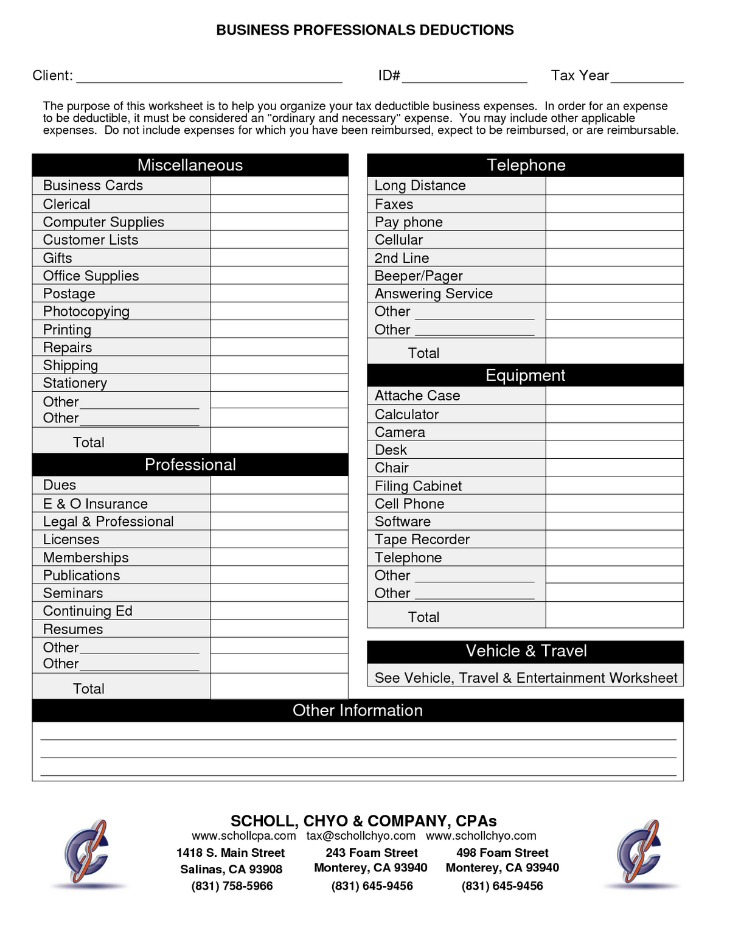

A 1031 exchange accountant aids in managing and optimizing the tax implications of exchanging properties. Here are several key roles they perform:

- Provide expert advice on qualification criteria.

- Assist with meticulous 1031 exchange tax calculation to determine potential deferrals.

- Ensure compliance with all requisite documentation.

Expert guidance from a 1031 exchange CPA can significantly streamline the process, offering peace of mind amidst stringent regulations.

Understanding the Intricacies of 1031 Exchange Tax Calculation

A comprehensive understanding of the 1031 exchange tax calculation is crucial. Calculating potential capital gain deferrals necessitates a precise evaluation of various elements such as depreciation recapture, adjusted property basis, and net sales proceeds.

The strategic insight offered by a CPA for 1031 exchange empowers real estate investors to make informed decisions, reducing the risk of costly missteps.

Finding the Right 1031 Exchange CPA Near You

Engaging a local expert can be highly advantageous. A 1031 exchange CPA near me can provide personalized service, familiarization with local market trends, and accessibility for client meetings.

FAQs

Q: What distinguishes a 1031 exchange CPA from other accountants?

A: A CPA for 1031 exchange specializes in the intricacies of real estate transactions specifically related to 1031 exchanges, ensuring precise tax calculations and compliance with IRS guidelines.

Q: How can a 1031 exchange CPA assist in timing matters?

A: They provide critical timing advice regarding the identification and purchasing deadlines, aligning your transactions with regulatory timelines to avoid disqualification.

The insight and precision a 1031 exchange accountant offers can make the difference between a seamless transaction and a chaotic one. Secure your financial future and harness the benefits of your real estate investments with the expertise of a diligent 1031 exchange CPA.